cash tax refund check with two names

Because banks have strict regulations for cashing checks made out to two parties youll have a lesson in togetherness as you cash a joint tax refund. I would write on the back of the check for deposit only and deposit it in through the ATM.

You wont be able to cash it however you can deposit it into your own account it does not have to be a joint account as long as one of your names on that.

. Further if the check is payable to you or your deceased husband then no problem at all. A Handling of checks when an executor or administrator has been appointed. I dont even use or anymore.

The format varies by state for refund checks but IRS joint refund checks are addressed with an and separating the names. To cash a check with 2 names separated by and contact your bank or financial institution since every bank has its own rules about this. You have the legal right to the proceeds.

MY NAME MOTHERS NAME 111 EXAMPLE ROAD AUSTIN TX. Banks have to verify the identity of everyone who signs the back of a check endorsing it so it can be cashed or deposited. If a check is written solely to your spouse she must sign the check.

The signatures required on an IRS refund check vary by the checks payee and your bank policies. If the check lists the names with. If the names are separated by a comma or andor or nothing at all you can endorse and cash the check yourself.

This is not legal advice. It dictates who can cash a joint check based on how it is written. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names.

When the Internal Revenue Service issues a tax refund to joint taxpayers in the form of a check you will receive the check with both of your names printed on it. I cannot cash nor deposit refund check in both my and deceased wifes name because I endorsed it. Otherwise any party named on the check can deposit it into his or.

One for their refund and then a second comprised of the interest on that payment the IRS announced last month. If you have a joint account the co-owner can cash your refund check on your behalf. This is called a multi-party or joint check.

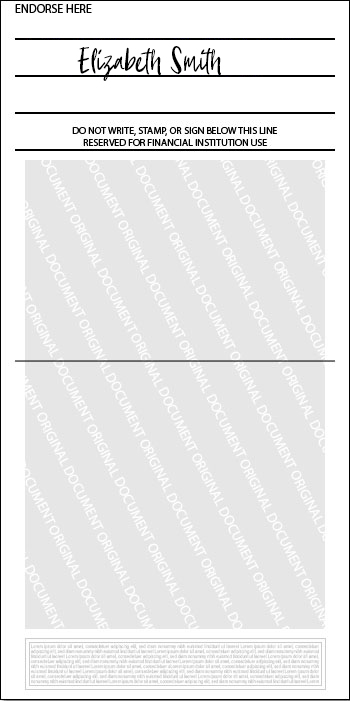

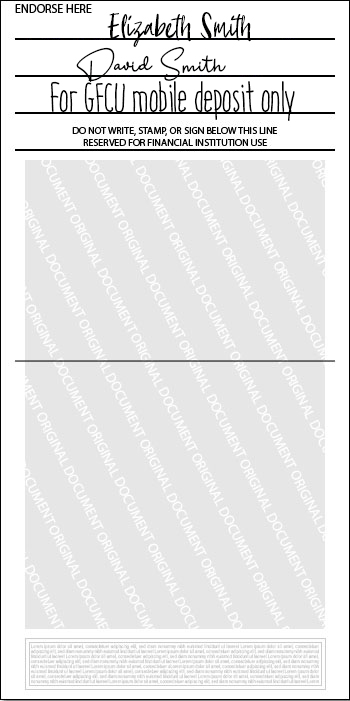

If you receive such a check you can tell how to deposit it at Advantis by noting how both names are written in the Payable To line. For example youd get a multi-party check if you are due a tax refund and you and your spouse filed a joint tax return. 1 An executor or administrator of an estate that has been appointed in accordance with applicable State law may indorse checks issued for the following classes of payments the right to which under law does not terminate with the death of the payee.

Most banks will allow this if both parties sign the check. If the names are separated by the words or or andor or by a comma or if each name is on a separate line. They felt badly about it and they eventually did cash it for me but they made sure I knew they were bending the rules for me.

The presence of and or and between names signify whether the couple must cash the check together or whether either party can cash it alone. You can return the joint-name check marked VOID along with Form 1310 to your local IRS office or the Internal Revenue Service Center where you filed your return along with a written request for reissuance of the refund check. Submit the check immediately to the appropriate IRS location see below.

And Checks Can Be Tricky. This year some Americans will actually receive two checks related to their taxes. Cashing a check with two names on it can be done in one of two main different ways depending on how the names are written out.

The location is based on the city possibly abbreviated on the bottom text line in front of the words TAX REFUND on your refund check. Theres hardly any risk if a check is made payable to two parties and youre depositing the funds into an account that bears the same two names but theres a risk that one person will forge the others signature and run. If a check with two names says and on the pay to the order of line then everyone has to endorse the check.

I need to file Survivors Affidavit DTF-281. Some banks require a refund from a joint income tax return to be deposited into a joint bank account. Banks seem to be more stringent when youre depositing a tax refund check thats written to more than one payee -- Bank of America and.

If you are unavailable to sign its possible for your account co-owner to deposit the check into the account with just one signature and withdraw cash at an ATM. You usually cant sign your spouses name. When I first looked at the check I noticed it had a symbol followed by my mothers name on the line below the one with my name.

If you do not check with your bank in advance it could refuse the refund causing it. Payments for the redemption of currencies or for. If the check is written to both of you.

You can find the location based on the abbreviated city name on the bottom text line in front of the words TAX REFUND on your refund check. Void the endorsement section on the back of the check. If you no longer have access to a copy of the check call the IRS toll-free at 800-829-1040 individual or 800-829-4933 business see telephone and local assistance for hours of operation and explain to the.

For paper checks that havent been cashed. Check the box on line A only if you received a refund check in your name and your deceased spouses name. How can I cash a jointly tax refund check with both spouse names on it if one spouse live in overseas.

I received my US federal tax return earlier this month. When a check is payable to two parties the cashing of the check is more difficult. I think it was a tax refund check so that might have made a difference too SInce that happened I never make checks out to two people anymore.

A new check will be issued in your name. One or the other only. If the issuer of the check lists the names with the word or in between them or the names are listed separately one to each line then either person may cash the check without the others permission.

The way you cash or deposit a multi-party check depends on how the names are written on the payee line the line on the check that starts with Pay to the order of and is followed by your name and the.

Tips For Depositing Your Government Issued Stimulus Or Tax Refund Check Greenville Federal Credit Union

Taxes 2022 Important Changes To Know For This Year S Tax Season

Tips For Depositing Your Government Issued Stimulus Or Tax Refund Check Greenville Federal Credit Union

Stimulus Checks White House Agrees To Tighten Eligibility Rules For 1 400 Direct Payments Sources Tax Forms Tax Irs

Stimulus Payments Find Tax Info You Need To See If You Get More Cnet

Printable Donation Receipt Template Free The Proper Receipt Format For Payment Received And General Basics Donation Letter Donation Form Letter Template Word

Beware Of The United States Treasury Check Scam

Inflation Ruining Your Budget 3 Clever Ways To Save While Shopping And More In 2022 Child Tax Credit Irs Taxes Tax Refund

Got An Unexpected Check In The Mail It May Be Fake The New York Times

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

What Is A Two Party Check Where Can You Cash It Mybanktracker

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Tds Online Payment Https Tdsonlinepayment Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax No Response

6 Exceptions To Paying Tax On Forgiven Debt Creditcards Com Paying Taxes Compare Credit Cards Forgiveness

Get Our Example Of Direct Deposit Payroll Authorization Form Payroll Legal Questions Being A Landlord

Explore Our Image Of Deposit Form For Bill Of Sale Email Template Business Contract Template Email Template Examples

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Prep For Freelancers Bloggers And Small Biz Owners Is Tricky So I Talked To Two Accountants Who Shared How T Filing Taxes Tax Services Federal Income Tax