student loan debt relief tax credit 2020

Student loan debt can reduce the amount of cash you have available to start a business or affect your credit score making it harder for you to secure a business loan. As part of relief for the COVID-19 pandemic the federal Coronavirus Aid Relief and Economic Security CARES Act passed in March provides significant student loan relief in.

Who Really Benefits From Student Loan Forgiveness The Atlantic

Will have maintained residency within the state of Maryland for the 2020 tax year Have.

. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. WASHINGTON The Internal Revenue Service and Department of the Treasury issued Revenue Procedure 2020-11 PDF that establishes a safe harbor extending relief to. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Federal Student Aid. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Student Loan Debt Relief Tax Credit Application.

Instructions are at the end of this application. For Maryland Residents or Part-year Residents Tax Year 2020 Only. You can claim the Student Loan Debt Relief Tax Credit if you meet the following conditions.

From July 1 2020 through September 15 2020. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt.

When you should use. A student mortgage debt settlement income tax loans is actually a program made under 10-740 regarding the Tax-General piece from the Annotated rule of Maryland to supply. If the credit is more than the taxes you would otherwise owe you will receive a tax.

Ii has at least 5000 in outstanding undergraduate or graduate student loan debt or both when submitting an application under subsection c of this section. You have incurred at least 20000 in total undergraduate andor graduate student loan debt. 3 months 135 times.

Student Loan Debt Settlement Tax Credit for Tax 2020 Details year This application together with instructions that are related for Maryland residents who would like to claim the. Start from Jul 01 2021 to Sep 15 2021. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

REPAYE Monthly payments are capped at 10 of your discretionary income and the remaining balance is forgiven after 20 years for undergraduate loans and 25 years for. In Indiana for example the state tax rate is 323. Governor Larry Hogan and Maryland Higher EducationCommission.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Complete the Student Loan Debt Relief Tax Credit application. B Subject to the limitations of.

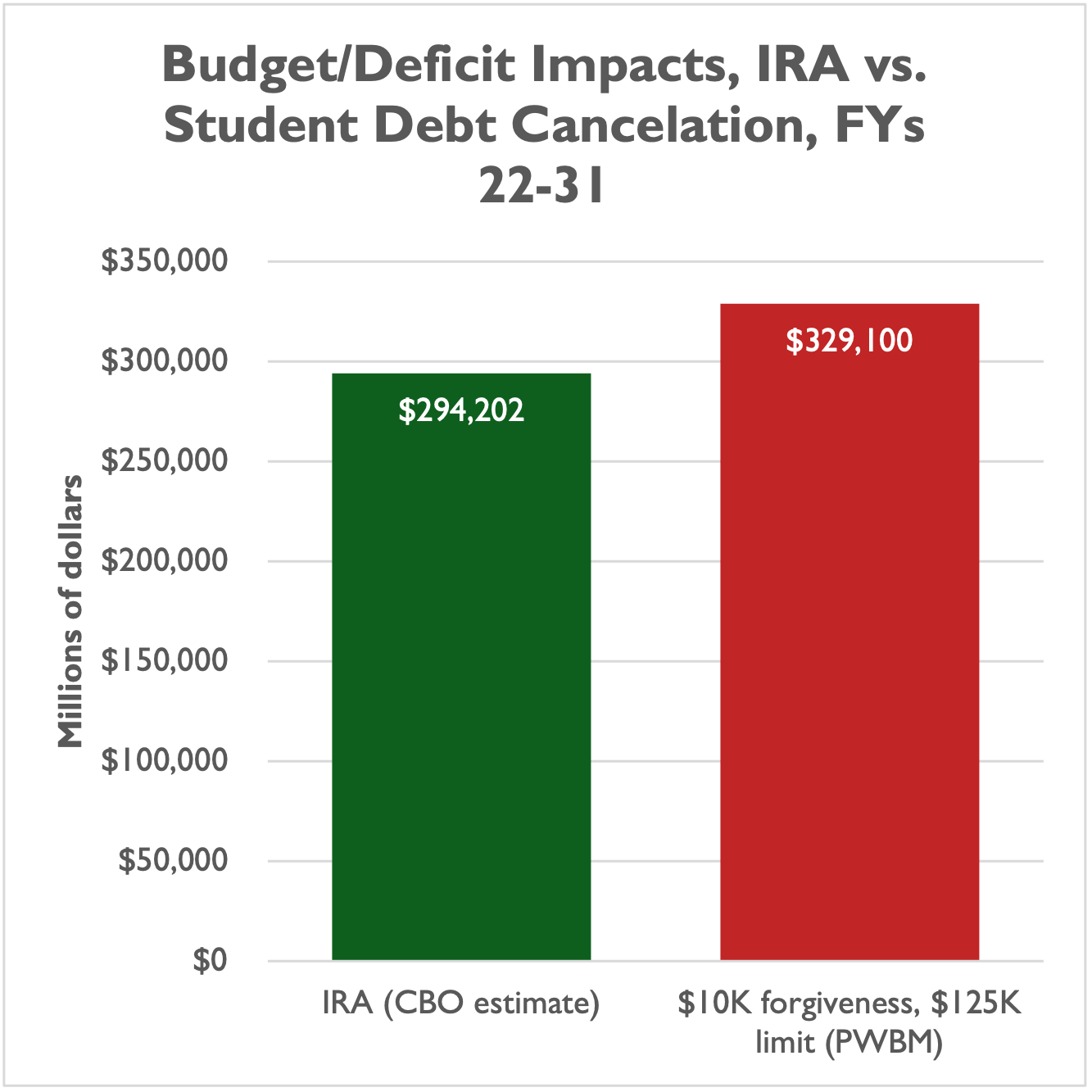

Price Tag Of Biden S Student Debt Relief Is About 400b Cbo Says Politico

Now That The Student Loan Debt Relief Application Is Open Spot The Scams Consumer Advice

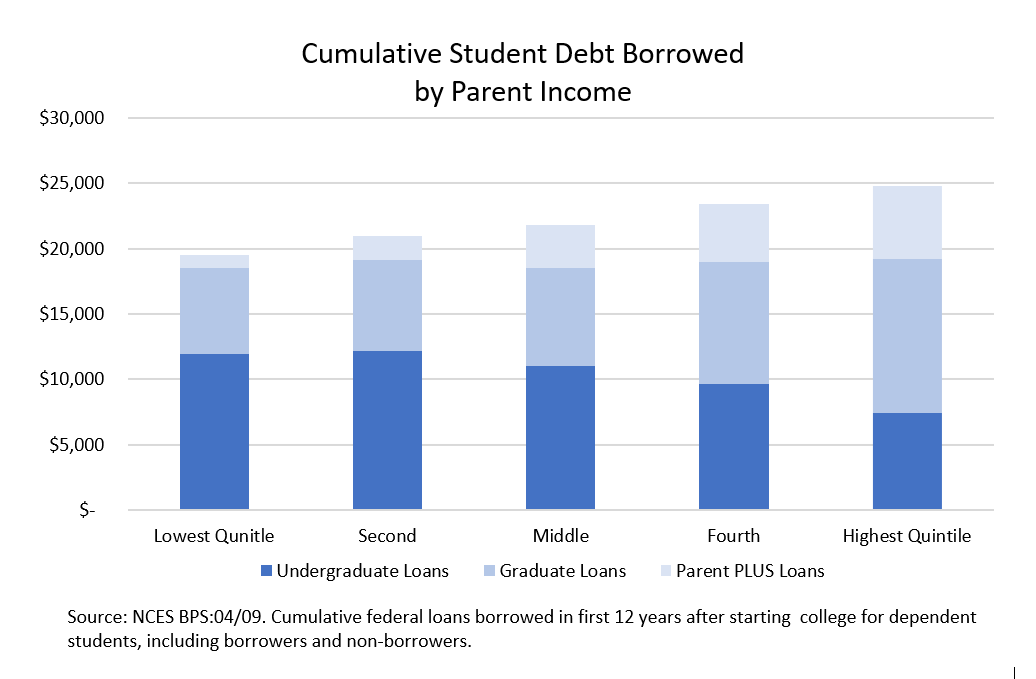

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Student Loan Forgiveness Government Opens Beta Version Of Application

Can Biden Forgive Student Loan Debt For College Undergraduates It S Complicated

Student Loan Debt Forgiveness Faq Who Gets Relief How Much Is Canceled And When Will It Happen Cnet

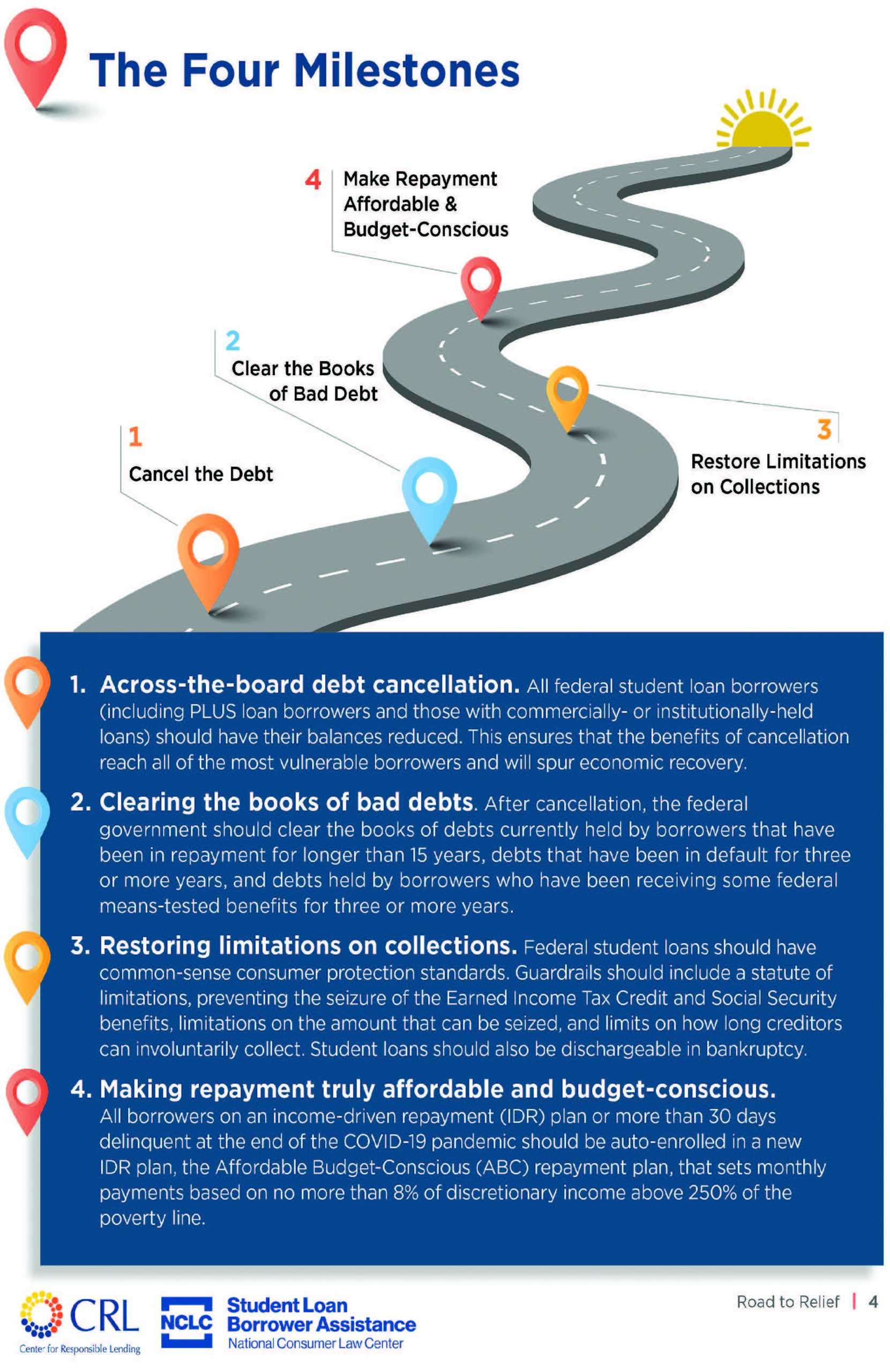

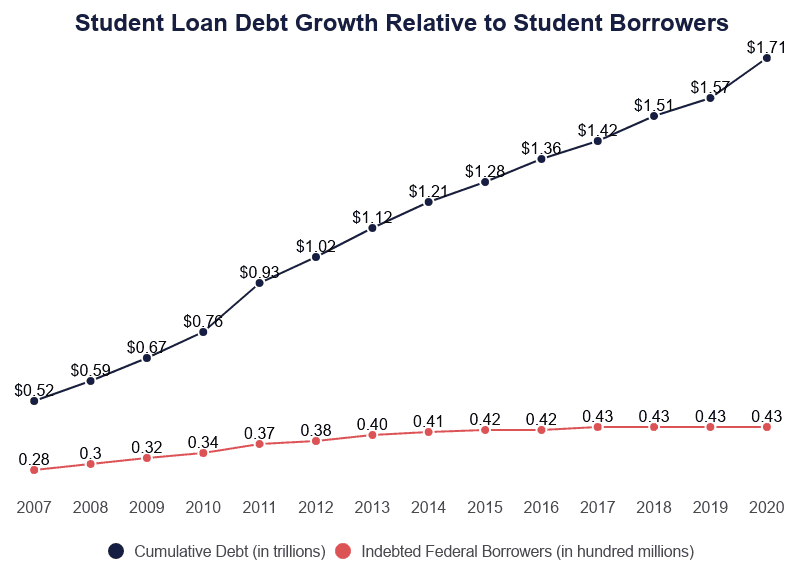

A Roadmap To Relieving America S 1 7 Trillion Student Debt New Pittsburgh Courier

Cost Of Student Debt Cancelation Could Average 2 000 Per Taxpayer Foundation National Taxpayers Union

Biden Is Right A Lot Of Students At Elite Schools Have Student Debt

Student Loan Forgiveness Forms Student Loan Planner

Can I Get A Student Loan Tax Deduction The Turbotax Blog

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Student Loan Debt Crisis In America By The Numbers Educationdata Org

Student Loan Forgiveness If You Qualify You Still Need To Apply R Coolguides

Student Loan Debt Relief Tax Credit Application Due Sept 15

Covid Tax Break Could Open Door To Student Loan Forgiveness Ap News

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero